Loading...

The ATM Trading Approach underpins all the trading activity, services and software offered by Aiding Trades.

ATM stands for the Aiding Trades Method and includes 3 core parts:

Volume Spread Analysis

Strength & Weakness Analysis

Multiple Timeframe Analysis

ATM blends these 3 parts together to provide a truly 3-dimensional approach.

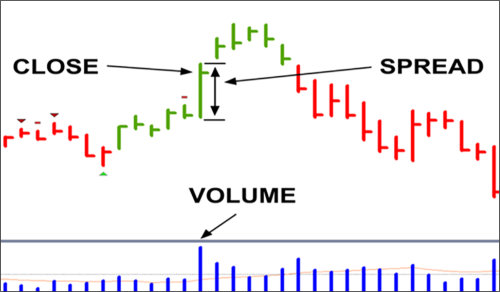

Volume Spread Analysis (VSA) is a trading methodology that interprets price movement and volume to gauge the intention of market makers. Developed from the work of Richard Wyckoff and popularized by Tom Williams, VSA provides insights into the dynamics between professional and retail traders, aiming to identify smart money activity.

Volume Spread Analysis offers a unique perspective by integrating volume and price action to uncover market sentiment and potential turning points. Traders using VSA aim to align themselves with professional or smart money by understanding market dynamics and making informed trading decisions.

Strength and weakness are fundamental concepts used to assess the underlying health of market moves. They represent the presence or absence of buying and selling pressure in the context of what professionals or smart money is doing.

Strength suggests either the buying interest of professional traders or the absence of their interest in selling. It’s often a sign that prices may rise or continue rising.

Weakness signals either professional interest in selling or lack of interest in buying. It often indicates that prices may fall or continue falling.

Analysing strength and weakness helps align your trading activity with the professional money, enebling you to enter trades at advantageous points when professional traders are likely accumulating or distributing positions.

Multiple Timeframe Analysis (MTFA) is a powerful approach used in trading and investing to analyse the same asset across different time intervals. By examining various timeframes, traders can have a comprehensive view of the market's underlying trends, potential reversal points, and overall context, which helps improve decision making.

Multiple Timeframe Analysis offers a structured approach to trading by aligning insights from different charts of the same instrument, enhancing the ability to spot high-probability trade setups, and improving overall risk management. By combining VSA with MTFA, traders can better understand market dynamics, align with professional money, and make better decisions.

Turnkey provides a complete trading solution for scalp trading FOREX, futures and cryptos using the ATM Trading Approach

The package includes:

ICOM trading course

ICOM trading strategy

Trading software that plugs into TradingView

Turnkey AI Coach to answer your trading questions